The first half of calendar year 2025 has drawn to a close, marked by significant volatility stemming from tariff-related uncertainties, geopolitical tensions, and downgrades in corporate earnings. Amidst this turbulence, gold emerged as a standout performer, delivering an impressive 25% return. Indian equity markets have nonetheless demonstrated resilience, with Nifty 50 gaining 7% year-to-date—just shy of its all-time high set in September 2024. Notably, US markets have surged past their previous peaks, defying concerns around growth slowdowns, tariff worries, and elevated bond yields.

As we move into the second half of CY25, the mood has brightened. Geopolitical tensions are easing, and greater clarity regarding US tariffs is emerging as negotiations make headway with several countries. A ceasefire between Israel and Iran has ended a 12-day conflict, and the resulting decline in crude oil prices and volatility has benefited India. The Indian Volatility Index (VIX) has dropped to near-record lows of 11%, highlighting the newfound market calm.

On the tariff front, the US has already struck deals with the UK and Vietnam. July will see a flurry of negotiations with Japan, India, Mexico, Canada, to name a few, followed by pivotal talks with China in August. The baseline expectation is that agreements will be reached with a few nations, including India, while deadlines may be extended for others. The rapid pace and scale of these simultaneous trade discussions are unprecedented, making outcomes difficult to predict. Nevertheless, India is well-positioned to negotiate tariffs in the range of 15–20%, potentially lower than its competitors, offering a relative advantage to Indian companies.

Domestically, India's economic momentum is strengthening, supported by positive high-frequency indicators. Of 100 key metrics, 70% show growth, led by a dynamic informal sector. The IMF and World Bank both project India's 2025 growth rate to be the highest among major economies at 6.25%. Two key shifts define the outlook for FY26: a pivot from investment-driven to consumption-led growth, and within consumption, a shift from the formal to the informal sector. Easing inflation has enhanced real purchasing power, fueling informal sector consumption that accounts for two-thirds of total demand. The government is further supporting consumption with a ₹6 trillion stimulus, including ₹1 trillion in tax cuts, ₹2 trillion in state-level cash transfers for women, and a ₹3 trillion pay hike for government employees under the 8th Pay Commission (for FY27).

Rural demand is also rebounding, bolstered by improving farm prices and positive real wage growth. The monsoon has exceeded expectations, running 4% above normal, with Kharif sowing up 12%. While urban sentiment remains muted, it is expected to recover over the next two to three quarters, aided by tax relief and lower EMIs. We anticipate a discernible uptick in discretionary consumption after the upcoming festive season, especially in the latter half of FY26.

In a decisive and unexpected move, the RBI implemented a front-loaded monetary easing by reducing repo rates by 50 bps to 5.5%, surpassing market expectations of a 25-bps cut. In addition, the RBI announced a 100-bps reduction in the Cash Reserve Ratio (CRR) to 3.0%, effective from September to November 2025. Recognizing that monetary policy operates with a lag, the RBI's proactive stance underscores a pronounced focus on stimulating economic expansion. Although yields have reacted sharply to the RBI's recent policy shift, with inflation well-managed and ample liquidity, the full transmission of monetary easing should result in longer-term bond yields softening from current levels.

Headline inflation continues its downward path, with CPI falling to 2.8% in May, well below the RBI's 4% target. This drop is largely attributable to lower food prices and stable core inflation. Looking ahead, inflation is expected to remain contained, underpinned by favorable monsoons and steady crude prices. Should inflation remain below RBI projections or growth falls short, another rate cut could be considered by year-end.

Amidst the global turbulence, India stands out for its relative economic stability. Several macroeconomic indicators have turned favorable, and corporate earnings are set to progressively improve. The first quarter of FY26 is poised to be a turning point, marking a shift from the subdued, low single-digit earnings growth of FY25 to more sustainable, double-digit growth in subsequent quarters. Notably, the frequency of corporate earnings downgrades has diminished, and overall sentiment is on the upswing.

On the liquidity front, the Dollar Index has declined by 11% from its recent peak, now sitting near the technical support level of 97. A weaker dollar signifies looser global financial conditions and increased liquidity, which can fuel capital flows into emerging markets, including India. June marked the fourth consecutive month of foreign institutional investor (FII) inflows into India. Simultaneously, domestic mutual fund flows remain robust, as systematic investment plans (SIPs) recorded their highest-ever monthly inflows of Rs 27,200 crore in June.

With the recent up-move in equity markets, valuations have also risen: the Nifty 50 now trades at a 5% premium to its 10-year average. Large-cap stocks currently offer the best risk-reward profile relative to mid- and small-caps, which remain relatively expensive. The confluence of softening crude prices, declining interest rates, and a weaker dollar creates a constructive macroeconomic backdrop. Additionally, progress on tariffs, geopolitical stability, and improving corporate earnings should further bolster equity markets through the remainder of the year.

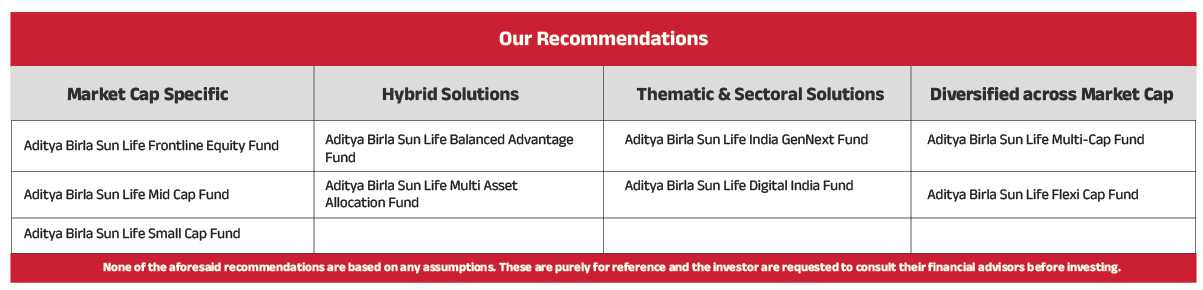

Consistent with our longstanding perspective, asset allocation remains the most robust strategy for navigating market volatility. Asset allocation vehicles, such as Multi Asset Funds and Balanced Advantage Funds, are preferred tools for weathering turbulence. Given relative valuation comfort in large-cap stocks, investors should prioritize Large-Cap and Flexi-Cap funds as core holdings, maintaining a minimum three-year horizon to fully capture the market's long-term potential.

While most gains from duration strategies have already materialized, fixed income investors should now shift their focus to accrual products. We recommend:

• For a 3+ month horizon: Ultra Short or Low Duration Fund

• For a 1+ year horizon: Short-Term Funds (Short Term/Corporate Bond category)

• For a 2+ year horizon: Debt Plus Arbitrage Fund of Funds (FOF), which also offers tax advantage

Looking ahead, India's economic fundamentals and its growing role in the global economy provide a solid foundation for patient investors. As we progress through FY26, it is crucial to remain anchored to these realities, maintaining a long-term perspective and stay resilient amid inevitable market fluctuations.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.